Optimizing Your Loaning Potential: Tips for Making the Many of Finance Opportunities

In browsing the landscape of obtaining prospective, individuals usually discover themselves at a crossroads where the choices they make might significantly influence their monetary future. The world of car loans can be a facility and often daunting one, with different possibilities providing themselves in different types. Comprehending exactly how to optimize these opportunities can be the secret to opening economic stability and development - Online payday loans. By executing critical strategies and insightful ideas, customers can place themselves positively to access the funding they need while additionally optimizing their terms. Everything starts with a thoughtful evaluation of one's monetary standing and an aggressive attitude in the direction of leveraging funding chances.

Analyzing Your Financial Situation

Upon embarking on the trip to make best use of loan possibilities, it is vital to begin by thoroughly analyzing your existing monetary situation. This proportion is a crucial statistics that lenders take into consideration when identifying your eligibility for a loan.

Researching Financing Choices

To effectively navigate the landscape of lending possibilities, extensive study into numerous car loan alternatives is vital for consumers seeking to make enlightened financial decisions. Performing detailed study includes checking out the conditions offered by various lending institutions, comprehending the kinds of car loans readily available, and contrasting rate of interest to recognize the most positive alternatives. By diving into the specifics of each funding item, borrowers can obtain understandings right into settlement terms, fees, and prospective charges, allowing them to pick a car loan that aligns with their monetary objectives.

In addition, useful site researching funding choices permits consumers to assess the trustworthiness and online reputation of lending institutions, guaranteeing they select a respectable institution that provides transparent and trusted services. Online sources, such as economic contrast internet sites and consumer testimonials, can supply useful details to help in the decision-making process. Furthermore, consulting with financial advisors or lending officers can give personalized advice based upon private scenarios. Eventually, extensive research encourages customers to make knowledgeable decisions when picking a loan that matches their requirements and monetary capabilities.

Improving Your Credit History Score

After completely investigating finance alternatives to make informed financial decisions, borrowers can now concentrate on boosting their credit rating score to improve their overall borrowing potential. A greater credit score not only enhances the possibility of finance authorization yet likewise enables debtors to gain access to loans with better terms and lower interest rates.

:max_bytes(150000):strip_icc()/what-are-basic-requirements-qualify-payday-loan.aspFinal-1b6684790a684488bc21480e6dced3b2.jpg)

Understanding Financing Terms

Recognizing lending terms is important for debtors to make educated monetary choices and successfully handle their borrowing obligations. Some car loans may have early repayment charges, which debtors must take into consideration if they intend to pay off the financing early. By extensively comprehending these terms prior to agreeing to a finance, debtors can make audio monetary decisions and avoid potential challenges.

Creating a Settlement Plan

Having a clear understanding of car loan terms try this site is basic for customers looking for to create a well-structured payment strategy that aligns with their economic objectives and reduces possible risks. When the financing terms are understood, the following action is to develop a repayment approach that suits the customer's monetary capacities.

If difficulties arise in conference payment responsibilities, notifying the lender early on can open up opportunities for renegotiation or restructuring of the loan terms. Inevitably, a well-balanced payment plan is important for fulfilling loan commitments properly and maintaining a healthy and balanced economic profile.

Verdict

To conclude, making the most of borrowing capacity calls for a complete analysis of monetary standing, research on funding choices, improvement of credit report, understanding of financing terms, and the development of an organized payment plan (Online payday loans). By complying with these actions, individuals can make the most of financing opportunities and accomplish their economic goals efficiently

Daniel Stern Then & Now!

Daniel Stern Then & Now! Anthony Michael Hall Then & Now!

Anthony Michael Hall Then & Now! Tahj Mowry Then & Now!

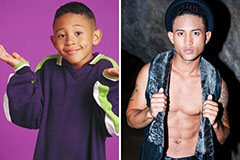

Tahj Mowry Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! McKayla Maroney Then & Now!

McKayla Maroney Then & Now!